Jump to a Policy Topic

Policy Issues

NBWA educates local and federal officials and regulators on the value of state-based alcohol regulation as well as the economic and regulatory issues that impact America’s beer distributors, who are local family-owned businesses that service every state and congressional district throughout the United States.

-

Revitalizing Local Businesses

The Issue: Bars, restaurants and entertainment venues impacted by the pandemic continue to face challenges with lower foot traffic and higher operating costs.

Why It Matters: Energy-efficient draft beer systems provide operational savings while encouraging on-premise spending. Providing tax incentives for draft systems will help bolster the hospitality industry that employs over 15 million Americans.

We Encourage Congress to:

- Support the Creating Hospitality Economic Enhancement for Restaurants and Servers (CHEERS) Act (H.R. 7577), which would provide a tax deduction for bars, restaurants and entertainment venues with draft beer systems

-

Pass-Through Deduction: Section 199A

The Issue: In the 2017 Tax Cuts and Jobs Act, Congress approved:

- A permanent reduction in the corporate income tax rate from 35% to 21%.

- A temporary 20% deduction for pass-through businesses (such as sole proprietorships, partnerships and S Corporations) for qualified business income.

Unlike the permanent reduction for C corporations, the 20% deduction for passthrough businesses is currently scheduled to expire at the end of 2025, which will create a disadvantage for these small businesses.

Why It Matters: Distributors qualify for the pass-through deduction under section 199A of the Internal Revenue Code. The deduction enables these local, Main Street businesses to stay competitive with Wall Street, create jobs and make investments in their communities

We Encourage Congress To:

- Cosponsor the Main Street Tax Certainty Act (H.R. 4721/S. 1706) to make the 20% pass-through deduction

permanent.

-

Corporate Transparency Act

The CTA, which took effect on January 1, 2024, requires specific business entities with 20 or less full-time employees and $5 million or less in gross receipts or sales to regularly report information about their beneficial owners to the Treasury Department’s Financial Crimes Enforcement Network.

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

Reporting Timeline

- Covered entities in existence prior to January 1, 2024 are required to report by January 1, 2025

- Businesses covered by this timeline may want to wait to assess the outcome of further litigation, possible legislation or other unknown delays

- Covered entities formed on or after January 1, 2024 are required to report within 90 days of receiving actual or public notice that their company’s creation or registration is effective

- Due to the shorter designation, businesses covered by this timeline will need to evaluate the legal, regulatory or legislative landscape when determining when to form a new entity

- Covered entities formed after January 1, 2025 are required to report within 30 days of receiving actual or public notice that their company’s creation or registration is effective

Important Exemption

- Entities with more than 20 full-time employees, more than $5 million gross receipts or sales and an operating presence at a physical office within the U.S.

Learn more about beneficial ownership reporting requirements and file your report at the FinCEN website.

- Covered entities in existence prior to January 1, 2024 are required to report by January 1, 2025

-

Alcohol and Tobacco Tax and Trade Bureau (TTB)

The Issue: The TTB serves as the primary federal regulator for the alcohol industry.

Why It Matters: TTB plays a key role in our nation’s well-regulated state-based alcohol system by maintaining a safe and competitive alcohol market and efficiently collecting tax revenue to serve American communities

We Encourage Congress To:

- Support and fully fund the TTB and to conduct appropriate oversight over its regulatory functions.

-

Federal Marijuana Policy

The Issue: As Congress continues its work on both marijuana and cannabidiol (CBD), including Delta-9 products, policymakers should draw on the expertise and experience of the alcohol industry and public health leaders.

Why It Matters: The lack of clarity in federal policy on THC and CBD products creates significant challenges for businesses seeking to take part in regulated commercial activity. Additionally, this lack of clarity continues to create workplace challenges.

We Encourage Congress To:

- Maintain the integrity of the existing alcohol regulatory structure and provide greater clarity to stakeholders on federal oversight of the marijuana and CBD marketplace.

- Draw on the expertise and experience of the alcohol industry and public health leaders as it considers federal oversight of the industry.

-

Dietary Guidelines for Americans

The Issue: The Departments of Health and Human Services (HHS) and Agriculture (USDA) are preparing the 2025-2030 Dietary Guidelines for Americans (DGA).

Why It Matters: The longstanding DGA definition of moderate consumption of alcohol (two drinks/day for men and one drink/day for women) has served the public well.

We Encourage Congress to:

- Urge HHS and USDA to continue to use well-founded, unbiased information and science as well as a transparent

process to inform the guidelines. - Urge HHS and USDA to keep Congress informed of their progress throughout the process.

- Urge HHS and USDA to continue to use well-founded, unbiased information and science as well as a transparent

-

Understanding the Differences Between Alcohol Beverage Products

The Issue: In 2020, Congress reinforced the longstanding principle that beer, wine and liquor should be taxed differently. These lines of distinction follow consensus public health and policy principles regarding alcohol.

Some liquor manufacturers are now attempting to blur these lines by:

- Proposing a lower tax rate for liquor-based beverages sold in a can.

- Seeking to expand the substitution drawback of excise taxes paid on imported alcohol to additional liquor-based products.

Why It Matters:

Public Health Consensus

- Congress has long recognized that liquor is not the same as beer. The average alcohol by volume (ABV) of liquor (distilled spirits) is approximately 40%, while the average ABV of beer is approximately 5%. It has been proven that liquor products with a higher alcohol concentration level can cause a greater degree of intoxication at a faster rate.

Maintaining Policy Definitions

- A cocktail served at a bar and a cocktail packaged in a can are both liquor-based and the packaging should not change the federal tax rate.

Competitive Fairness

- Existing federal tax policy already offers significant support to liquor manufacturers and contributes to a vibrant spirits industry. Even as liquor’s market share continues to grow, its effective tax rate is significantly reduced by government credits and refunds that exist in current tax law. Congress should avoid further attempts by some in the spirits industry to expand liquor tax advantages.

We Encourage Congress To:

- Oppose the Duty Drawback Clarification Act (H.R. 4073/S. 1781), which would allow certain liquor producers to further lower their effective tax rate by expanding the substitution drawback program.

- Maintain federal alcohol policy that reflects the differences between alcohol beverage products.

- Continue to make health a top priority when debating federal alcohol policy, including restricting underage access, preventing adulterated or contaminated products from entering the marketplace and promoting responsible consumption.

-

Tax Competitiveness for Main Street Businesses

NBWA represents multi-generational, family-owned small businesses that deliver substantial economic benefits for their communities. As Congress faces a variety of expiring tax provisions, providing tax competitiveness and certainty for Main Street will help beer and beverage distributors continue to grow jobs, elevate wages and stimulate the economy.

Estate Tax

The Issue: The 2017 Tax Cuts and Jobs Act increased the estate tax exemption, which is currently $13.61 million per individual for 2024. Unless there is further action from Congress, estate tax exemption levels will revert to $5 million per individual at the end of 2025, a significant change for small businesses.

Why It Matters: Congress should cosponsor legislation that supports small family businesses and farms and reject efforts to reduce the estate tax exemption or raise current estate tax rates.

We Encourage Congress To:

- Cosponsor H.R. 7035/S. 1108, which would permanently repeal the estate tax to help family businesses.

Full and Immediate Expensing/Bonus Depreciation

The Issue: Bonus depreciation allows businesses to deduct 100% of the cost of new investments, such as machinery and equipment, in the year of purchase. Congress is currently considering legislation to extend full bonus depreciation but only through 2025.

Why It Matters: Making full bonus depreciation permanent will encourage business investment, support growth and create more employment.

We Encourage Congress To:

- Cosponsor the Accelerate Long-term Investment Growth Now (ALIGN) Act (H.R. 2406/S. 1117), which would make permanent the full expensing of qualified equipment.

-

Multiemployer Pension Plans

Multiemployer Pension Plans

The Issue: The long-term stability of multiemployer-defined benefit pension plans is unclear. Recent proposals from the Pension Benefit Guaranty Corporation could increase withdrawal liability.

Why It Matters: Beer distributors who participate in these pension plans are required to meet their contribution responsibilities. While some of the most troubled plans have been temporarily stabilized after receiving Special Financial Assistance, further action is needed to ensure long-term stability.

We Encourage Congress To:

- Address withdrawal and partial withdrawal liability, including requirements that could harm small businesses.

-

Independent Distribution: Essential to Balance in the Alcohol Industry

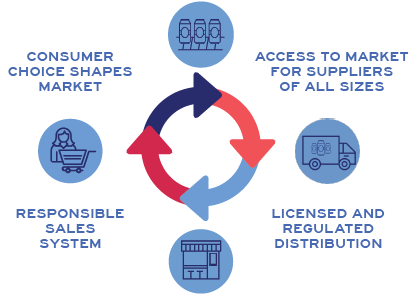

Americans enjoy safe access to the world’s greatest variety of alcohol beverage products because of the state-based alcohol regulatory structure created by the 21st Amendment. This structure carefully balances control and access through a licensed and secure alcohol sales system — licensed suppliers selling to licensed distributors selling to licensed retailers.

More than 3,000 independent beer and beverage distributors across the country play an essential role in this system that provides Americans with a safe, well-regulated and competitive marketplace that promotes a wide and constantly growing variety of product choices.

Watch a short video about how our nation’s successful alcohol regulations work.

The Congressional 21st Amendment Caucus

The Issue: The newly formed 21st Amendment Caucus recognizes the importance of state and federal alcohol regulations as well as the role of licensed alcohol businesses in collecting taxes, supporting public health priorities and creating and maintaining a competitive, safe and efficient market. The caucus is supported by members of the supplier, distributor and retail tiers.

Why It Matters: It is important for Congress to share the value of maintaining effective, state-based alcohol regulation for American consumers and the marketplace.

We Encourage House Members To: Join the 21st Amendment Caucus and support effective, state-based alcohol regulation.

Consumer Protection, Economic Impact and Regulatory Accountability

The Issue: Legislators and regulators make decisions that can bolster or undermine our nation’s state-based alcohol regulatory system.

Why It Matters: American consumers enjoy safe and efficient access to the world’s most dynamic and competitive alcohol market because suppliers/importers, distributors and retailers all play important and separate roles within the alcohol regulatory system. This system delivers…

Safety

- The chain of custody ensures product integrity and helps keep alcohol away from minors.

Competition

- Independent distributors make it possible for suppliers of all sizes and locations to have access to the U.S. alcohol market, resulting in unparalleled consumer choice.

Economic Impact

- This system drives efficient collection of nearly $40 billion in annual tax revenue while creating over 137,000 distribution jobs across the country. It also provides manufacturers of all sizes with access to scaled distribution.

Independence

- The separation of functions provides regulatory safeguards against anti-competitive behavior that can undermine consumer objectives.

We Encourage Congress To: Support policies that protect the American public and reinforce the state-based system of effective alcohol regulation.

-

Workforce and Commercial Driver’s License

The Issue: Beer and beverage distributors provide competitive wages, benefits and long-term career opportunities. However, they face significant labor shortages, particularly for CDL drivers.

Why It Matters: Over 3,000 independent beer distribution facilities employ more than 137,000 Americans. These businesses play a critical role in supporting local economies and their labor challenges ripple throughout the supply chain of the smallest towns and biggest cities.

We Encourage Congress to:

- Take steps to address the nationwide labor and CDL shortage and challenges to the supply chain, including apprenticeships, trade school and community college initiatives.