About the Beer Purchasers’ Index

By: Lester Jones, NBWA Vice President, Analytics and Chief Economist

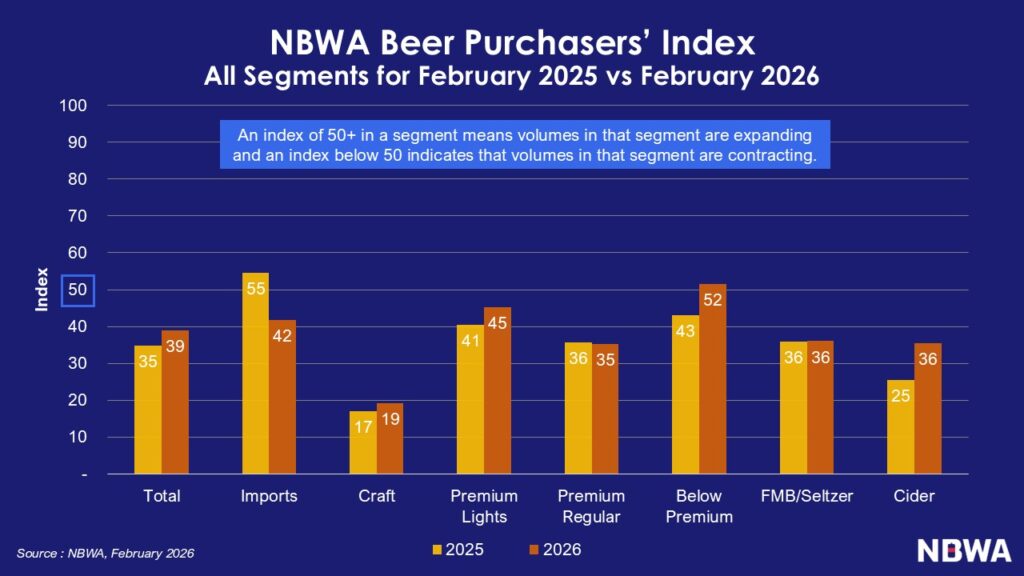

The NBWA Beer Purchasers’ Index (BPI) is an informal monthly statistical release giving distributors a timely and reliable indicator of industry beer purchasing activity. BPI is the only forward-looking indicator for the industry to measure expected beer demand (one month forward) in the marketplace. Similar to the widely recognized Purchasing Managers’ Index, the BPI is a net-rising index and a leading indicator of industry performance based on survey responses from participating beer purchasers. The index surveys beer distributors’ purchases across different segments and compares them to that of previous years’ purchases. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

The Latest Data

The BPI reading of 39 marks a four-point improvement from February 2025 and is even with last month’s reading. This represents the first year-over-year increase for overall BPI since January 2025.

Combined readings for at-risk inventory (47) and BPI (39) place the industry in cautionary territory for a second consecutive month — the first two-month stretch outside of contractionary territory since December 2024 through January 2025.

Across segments, Below Premium entered expansionary territory for the second time in the past year, while Cider recorded a year-over-year increase for the tenth consecutive month.

Looking across the segments for February:

- The imports index at 42 is 13-points lower than February 2025 and two points lower than January 2026.

- The craft index at 19 is two points higher than February 2025 and two points lower than January 2026.

- The premium lights index at 45 is four points higher than February 2025 and seven points higher than January 2026.

- The premium regular index at 35 is one point lower than February 2025 and three points lower than January 2026.

- The below premium index at 52 is nine points higher than February 2025 and two points higher than January 2026.

- The FMB/seltzer index at 36 is even with February 2025 and seven points lower than January 2026.

- The cider segment at 36 is 11 points higher than February 2025 and four points lower than January 2026.

Beer Distributors

Please sign up to participate and receive the first and only advance notice of expectations for increasing or decreasing sales. Complete the form below using your company’s primary beer purchaser’s contact information. For additional information, please email bpi@nbwa.org.

Beer Distributor Expectations Sign Up

Sign up to participate and receive the first and only advance notice of expectations for increasing or decreasing sales!