Jump to a Policy Topic

Policy Issues

NBWA educates local and federal officials and regulators on the value of state-based alcohol regulation as well as the economic and regulatory issues that impact America’s beer distributors, who are local family-owned businesses that service every state and congressional district throughout the United States.

-

Competitive Tax Policy for Main Street: Pass-Through Businesses/S-Corps

The Issue: While Wall Street received permanent tax relief in the 2017 Tax Cuts and Jobs Act, Main Street businesses face a significant tax increase when the bill’s temporary policies for pass-through businesses expire at the end of this year. Pro-growth provisions should be made permanent to maintain competitive tax policy.

Why It Matters: Tax certainty is important to multi-generational, family-owned businesses like NBWA members, the vast majority of which are organized as S-Corps. Without further action from Congress, beer and beverage distributors as well as other local businesses face a tax increase that will hurt their ability to:

Compete With Wall Street and Create Jobs

- If these provisions expire, NBWA members will need to forego critical investments in hiring workers, building warehouses and purchasing equipment.

Invest in Their Communities

- When distributors purchase new vehicles or equipment and raise wages for workers, those investments go directly into the local economy — supporting jobs and growth.

Key pro-growth provisions that should be made permanent:

- Temporary Pass-Through Deduction: Section 199A (Expires end of 2025)

- Adjusted Estate Tax Exemption (Expires End of 2025)

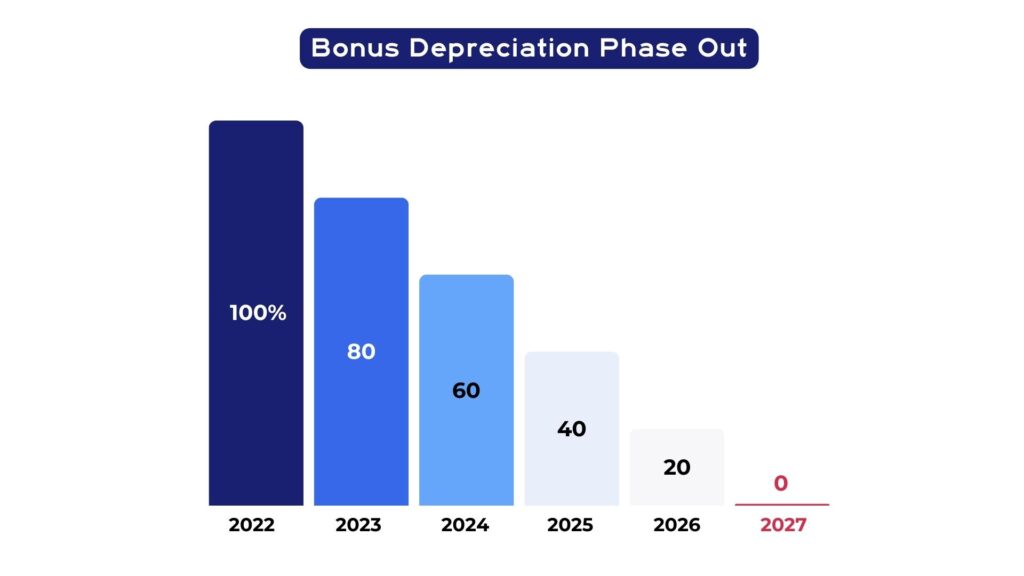

- Bonus Depreciation & Interest Deductibility (Bonus Depreciation being phased out now; will be fully phased out by 2027)

-

Temporary 20% Pass-Through Deduction: Section 199A

Expires at the End of 2025

Wall Street businesses received a permanent reduction in the corporate tax rate (35% to 21%) in the 2017 bill. Maintaining the pass-through deduction is essential for Main Street businesses like beer distributors to remain competitive and continue investing in their communities.

We Encourage Congress to:

Cosponsor the Main Street Tax Certainty Act (H.R. 703/S. 213)

This would make the 20% pass-through deduction permanent. Contact:- Rep. Smucker: Noelle.Britton@mail.house.gov, 202-225-2411

- Rep. Gottheimer: Max.Raymond@mail.house.gov, 202-225-4465

- Rep. Cuellar: Patrick.Oconnor2@mail.house.gov, 202-225-1640

- Sen. Daines: Caroline_Oakum@daines.senate.gov, 202-224-2651

-

Adjusted Estate Tax Exemption

Expires at the End of 2025

Family businesses will face a steep tax increase if the adjusted exemption is allowed to expire.

We Encourage Congress to:

Cosponsor H.R. 1301/S. 587

This would provide family businesses with estate tax relief and the ability to plan for their future. Contact:- Rep. Feenstra: Connor.Rabb@mail.house.gov, 202-225-4426

- Rep. Bishop: Jonathan.Halpern@mail.house.gov, 202-225-3631

- Sen. Thune: Adam_Wek@thune.senate.gov, 202-224-2321

-

Bonus Depreciation (Full and Immediate Expensing) & Interest Deductibility

Expires at the End of 2025

Bonus depreciation allows businesses to deduct the cost of new qualified investments in equipment, facilities and vehicles. It is being phased out now and will be fully phased out by 2027. Interest deductibility encourages community investment by enabling businesses to reduce related financing costs.

We Encourage Congress to:

Cosponsor the Accelerate Long-term Investment Growth Now (ALIGN) Act (H.R. 574/S. 187)

This would make full expensing of qualified equipment permanent. Contact:- Rep. Arrington: Jonathan.Kupperman@mail.house.gov, 202-225-4005

- Sen. Lankford: Jesse_Mahan@lankford.senate.gov, 202-224-5754

-

State-Based Alcohol Regulation: Delivering Safety and Promoting Growth

The Issue: America’s state-based alcohol regulatory system, established by the 21st Amendment, has created the world’s safest and most vibrant alcohol marketplace. This structure carefully balances control and access through a licensed and secure alcohol sales system.

More than 3,000 independent beer distributors play an essential role in this system. They work closely with state and municipal governments to collect taxes, combat underage drinking and support efforts to ensure that local laws are being followed.

Why It Matters: Legislators make decisions that can bolster or undermine this system. One policy that would undermine effective regulation is allowing alcohol to be shipped through the U.S. Postal Service. Shipping alcohol through the mail preempts state law, removes licensing requirements and is harmful to our nation’s successful state-based alcohol regulatory structure, which provides:

Public Safety- Chain of custody enables product integrity

- Local authority enables communities to decide how alcohol is sold and regulated

Competition

- Suppliers of all sizes — including small, local brewers — have access to the market

- The result: 9,000 breweries and unparalleled consumer choice

Growth

- Efficient collection of more than $65 billion in annual tax revenue

- Over 135,000 well-paying distributor jobs

We Encourage Congress to:

Maintain our nation’s successful state-based alcohol regulatory system and reject any legislative efforts to allow shipping alcohol through the mail

Join the 21st Amendment Caucus

House Members can support a system of effective, state-based alcohol regulation. Contact:

• Rep. Bice: Robert.Sar@mail.house.gov, 202-225-2132

• Rep. Lee: Aneil.Gill@mail.house.gov, 202-225-3252 -

Moderate Alcohol Consumption and Health

The Issue: This year, the Departments of Health and Human Services (HHS) and Agriculture (USDA) are revising the Dietary Guidelines for Americans related to alcohol consumption.

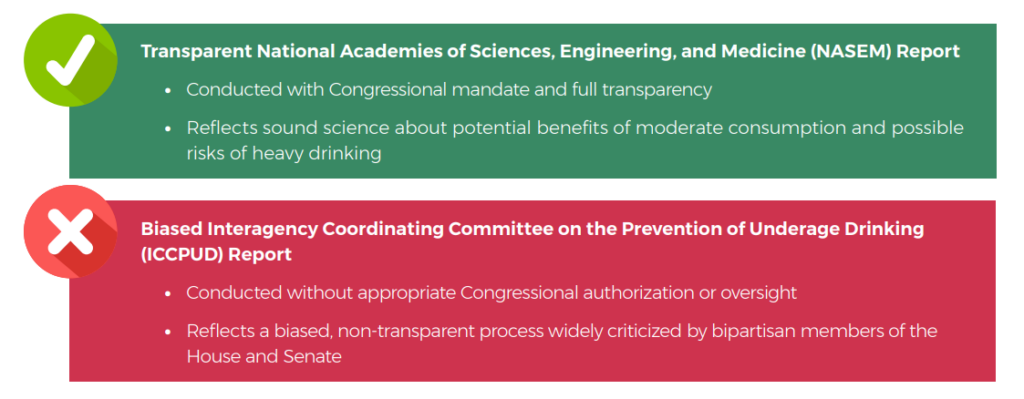

Two government reports were released under the previous administration:

Why It Matters: Americans deserve public health guidelines that are transparent, free from bias and based on the preponderance of sound scientific and medical knowledge. The existing Dietary Guidelines recommendations are:

- Guided by science that has been transparently reviewed, analyzed and debated.

- Based on over 40 years of peer-reviewed research on consumer wellness with regard to alcohol consumption.

- Developed through a process that included public input.

We Encourage Congress to:

Urge HHS and USDA to continue to prioritize science in decision-making

The agencies should use well-founded, unbiased information and science as well as a transparent process to inform any guidance on alcohol consumption.Support the existing Dietary Guidelines

The current recommendations reflect a process that is transparent, free from bias and based on the preponderance of sound scientific and medical knowledge. -

Tariffs and Trade

The Issue: The $400 billion American beer industry will be impacted by changes to national trade policy, including tariffs and other levies placed on imported goods.

Why It Matters: America’s 3,000 independent beer distributors supplement their robust portfolio of domestic products with beer and beverages from across the globe. Additionally, the beer industry uses a significant amount of aluminum and steel in products ranging from cans and packaging to warehouse and delivery equipment. It is important for lawmakers and the administration to consider the vital role that beer and beverage distributors play in local economies and the impact tariffs may have on this critical industry.

We Encourage Congress To:

Support pro-growth trade policies that benefit both consumers and local economies.

-

Differences Between Alcohol Products

The Issue: In 2020, Congress reinforced the longstanding principle that beer, wine and liquor should be taxed differently. These lines of distinction follow consensus public health and policy principles regarding alcohol. Some liquor manufacturers are now attempting to blur the lines by:

- Proposing a lower tax rate for liquor-based beverages sold in a can.

- Seeking to expand the substitution drawback of excise taxes paid on imported alcohol.

We Encourage Congress To:

Maintain federal alcohol tax policy that reflects the differences between alcohol beverage products.

Oppose the Duty Drawback Clarification Act, which has been introduced in previous Congresses.

It would allow certain liquor producers to further lower their effective tax rate by expanding the substitution drawback program on imports. -

Federal Cannabis Policy

The Issue: As Congress and the administration continue their work on cannabis policy, including hemp-derived Delta-9 products, policymakers should draw on the expertise and experience of the alcohol industry and public health.

Why It Matters: States are considering how to appropriately regulate THC and CBD products. The lack of clarity in federal policy on these products creates significant workplace challenges for businesses and hurts their ability to make informed business development decisions

We Encourage Congress To:

Draw on the expertise and experience of the alcohol industry while considering federal policies that maintain the integrity of the existing alcohol regulatory structure, providing clarity to businesses and protecting consumers.

-

Workforce and Commercial Driver’s License

The Issue: Beer and beverage distributors provide competitive wages, meaningful benefits and long-term career opportunities. However, they face significant labor shortages, particularly for CDL drivers.

Why It Matters: Over 3,000 independent beer distribution facilities employ more than 135,000 hardworking Americans. These businesses play a critical role in supporting local economies and ongoing labor challenges ripple through the supply chain, from the smallest towns to the largest cities.

We Encourage Congress to:

Take steps to address the nationwide labor and CDL shortages that create challenges to the supply chain.

Provide support for CDL training including apprenticeships, trade school and community college initiatives.

-

Multiemployer Pension Plans

Multiemployer Pension Plans

The Issue: The long-term stability of multiemployer-defined benefit pension plans is uncertain. Recent proposals from the Pension Benefit Guaranty Corporation could increase withdrawal liability

Why It Matters: Beer distributors who participate in these pension plans are committed to meeting their contribution responsibilities. While some of the most troubled plans have been temporarily stabilized after receiving Special Financial Assistance, further action is needed to ensure long-term stability

We Encourage Congress To:

Address withdrawal and partial withdrawal liability, including requirements that could harm small businesses.

-

Revitalizing Local Businesses

The Issue: Bars, restaurants and entertainment venues impacted by the pandemic continue to face challenges with lower foot traffic and higher operating costs.

Why It Matters: Energy-efficient draft beer systems provide operational savings while encouraging on-premise spending. Providing tax incentives for draft systems will help bolster the hospitality industry that employs over 16 million Americans.

We Encourage Congress to:

- Support the Creating Hospitality Economic Enhancement for Restaurants and Servers (CHEERS) Act when it is reintroduced. This legislation would provide a tax deduction for bars, restaurants and entertainment venues with energy-efficient draft beer systems.